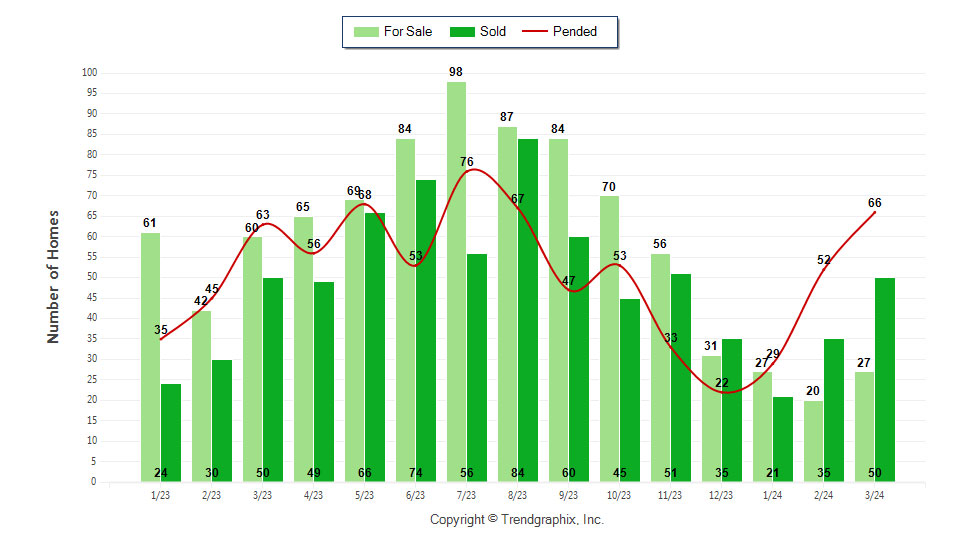

March 2024 was a Seller's market! The number of for sale listings was down 55% from one year earlier and up 35% from the previous month. The number of sold listings was the same year over year and increased 42.9% month over month. The number of under contract listings was up 26.9% compared to previous month and up 4.8% compared to previous year. The Months of Inventory based on Closed Sales was 0.5, down 58.3% from the previous year.

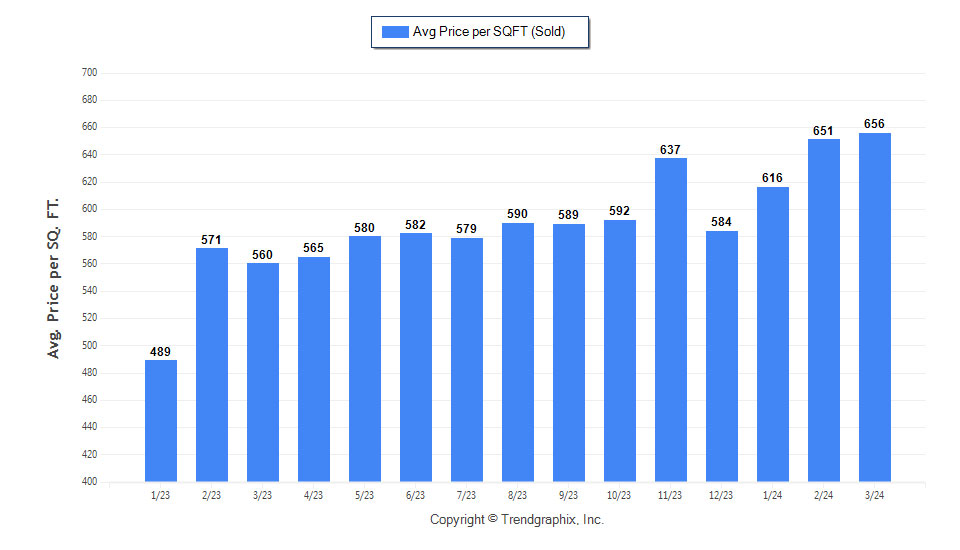

The Average Sold Price per Square Footage was up 0.8% compared to previous month and up 17.1% compared to last year. The Median Sold Price decreased by 1.5% from last month. The Average Sold Price also decreased by 0.4% from last month. Based on the 6 month trend, the Average Sold Price trend was "Neutral" and the Median Sold Price trend was "Neutral".

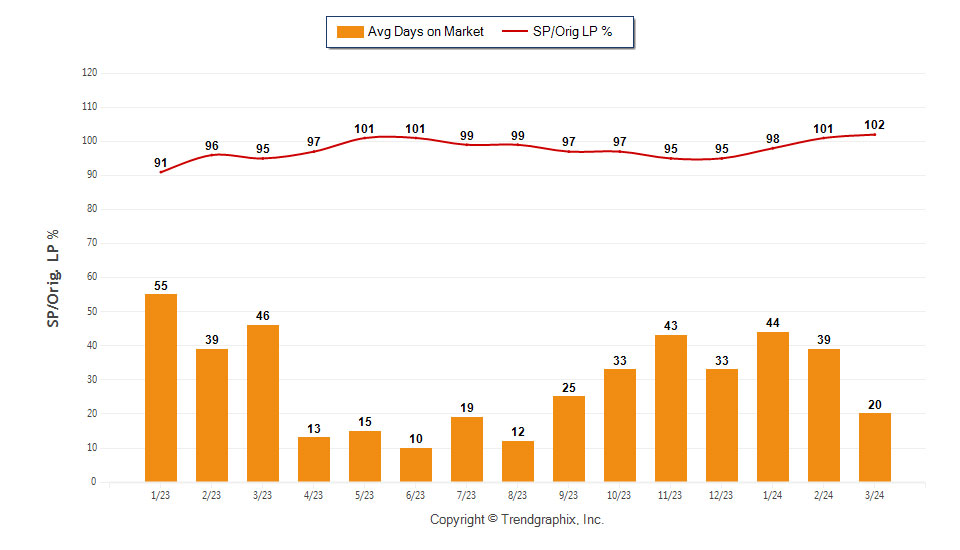

The Average Days on Market showed a downward trend, a decrease of 56.5% compared to previous year. The ratio of Sold Price vs. Original List Price was 102%, an increase of 7.4% compared to previous year.

It was a Seller's Market

Property Sales (Sold)

March property sales were 50, the same as in March of 2023 and 42.9% higher than the 35 sales last month.

Current Inventory (For Sale)

Versus last year, the total number of properties available this month was lower by 33 units of 55%. This year's smaller inventory means that buyers who waited to buy may have smaller selection to choose from. The number of current inventory was up 35% compared to the previous month.

Property Under Contract (Pended)

There was an increase of 26.9% in the pended properties in March, with 66 properties versus 52 last month. This month's pended property sales were 4.8% higher than at this time last year.

The Average Sold Price per Square Footagewas Appreciating*

The Average Sold Price per Square Footage is a great indicator for the direction of property values. Since Median Sold Price and Average Sold Price can be impacted by the 'mix' of high or low end properties in the market, the Average Sold Price per Square Footage is a more normalized indicator on the direction of property values. The March 2024 Average Sold Price per Square Footage of $656 was up 0.8% from $651 last month and up 17.1% from $560 in March of last year.

* Based on 6 month trend – Appreciating/Depreciating/Neutral

The Days on Market Showed Downward Trend*

The average Days on Market (DOM) shows how many days the average property is on the market before it sells. An upward trend in DOM trends to indicate a move towards more of a Buyer’s market, a downward trend indicates a move towards more of a Seller’s market. The DOM for March 2024 was 20, down 48.7% from 39 days last month and down 56.5% from 46 days in March of last year.

The Sold/Original List Price Ratio was Rising**

The Sold Price vs. Original List Price reveals the average amount that sellers are agreeing to come down from their original list price. The lower the ratio is below 100% the more of a Buyer’s market exists, a ratio at or above 100% indicates more of a Seller’s market. This month Sold Price vs. Original List Price of 102% was up 1% % from last month and up from 7.4% % in March of last year.

* Based on 6 month trend – Upward/Downward/Neutral

** Based on 6 month trend – Rising/Falling/Remains Steady

All reports are published April 2024, based on data available at the end of March 2024, except for the today’s stats. Information and statistics derived from Northwest Multiple Listing Service. Neither the Board or its MLS guarantees or is in any way responsible for its accuracy. Data maintained by the Board or its MLS may not reflect all real estate activity in the market. Report reflects activity by all brokers participated in the MLS.

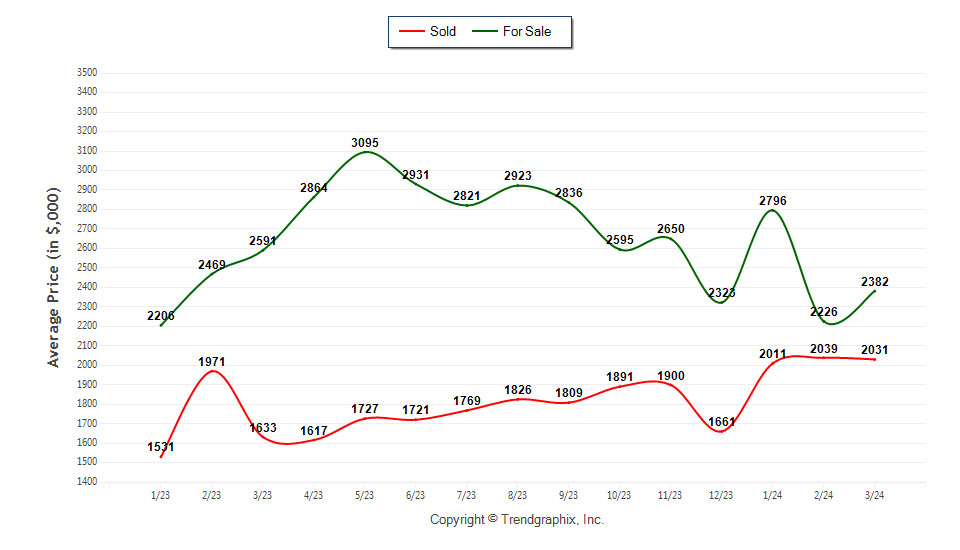

The Average For Sale Price was Neutral*

The Average For Sale Price in March was $2,382,000, down 8.1% from $2,591,000 in March of 2023 and up 7% from $2,226,000 last month.

The Average Sold Price was Neutral*

The Average Sold Price in March was $2,031,000, up 24.4% from $1,633,000 in March of 2023 and down 0.4% from $2,039,000 last month.

The Median Sold Price was Neutral*

The Median Sold Price in March was $1,925,000, up 23.9% from $1,554,000 in March of 2023 and down 1.5% from $1,955,000 last month.

* Based on 6 month trend – Appreciating/Depreciating/Neutral

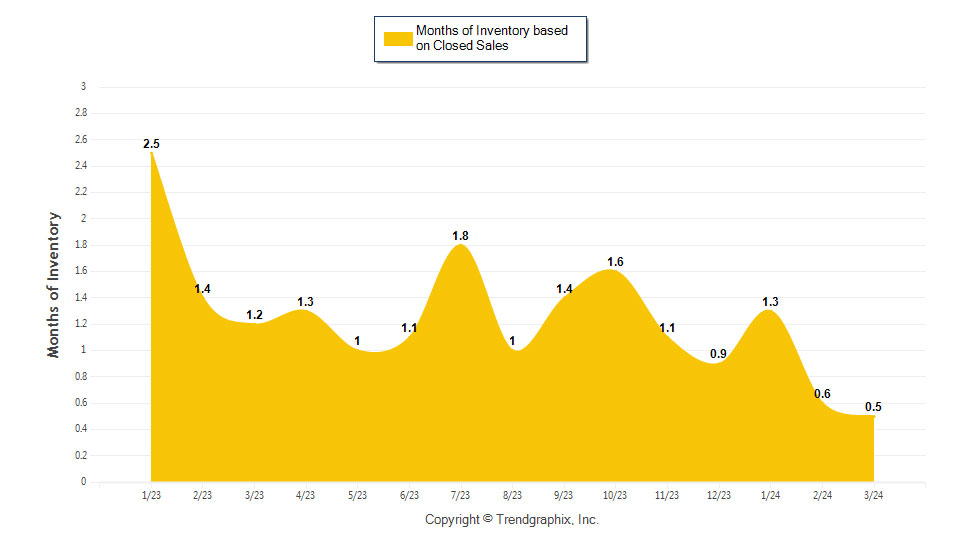

It was a Seller's Market*

A comparatively lower Months of Inventory is more beneficial for sellers while a higher months of inventory is better for buyers.

*Buyer’s market: more than 6 months of inventory

Seller’s market: less than 3 months of inventory

Neutral market: 3 – 6 months of inventory

Months of Inventory based on Closed Sales

The March 2024 Months of Inventory based on Closed Sales of 0.5 was decreased by 58.3% compared to last year and down 17.5% compared to last month. March 2024 was Seller's market.

Months of Inventory based on Pended Sales

The March 2024 Months of Inventory based on Pended Sales of 0.4 was decreased by 63% compared to last year and the same compared to last month. March 2024 was Seller's market.

All reports are published April 2024, based on data available at the end of March 2024, except for the today’s stats. Information and statistics derived from Northwest Multiple Listing Service. Neither the Board or its MLS guarantees or is in any way responsible for its accuracy. Data maintained by the Board or its MLS may not reflect all real estate activity in the market. Report reflects activity by all brokers participated in the MLS.

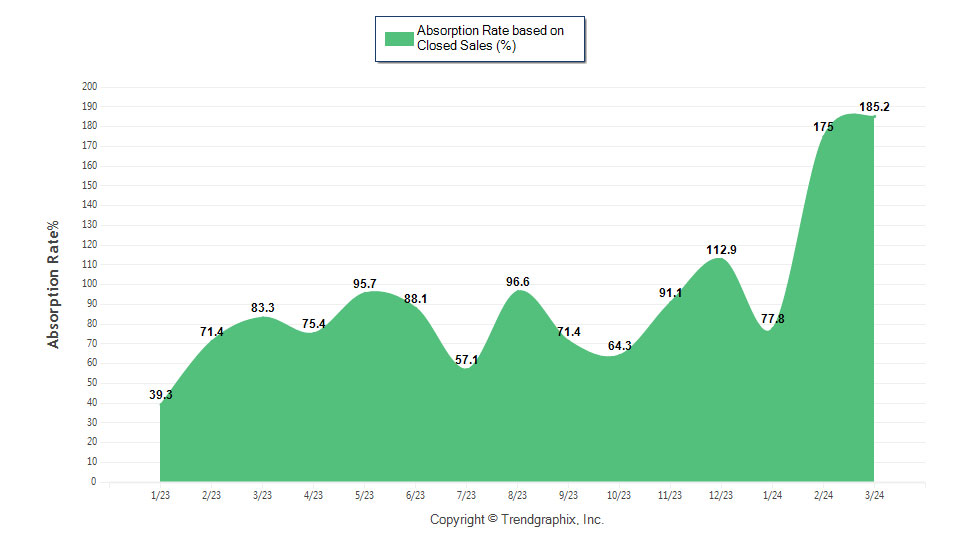

It was a Seller's Market*

Absorption Rate measures the inverse of Months of Inventory and represents how much of the current active listings (as a percentage) are being absorbed each month.

*Buyer’s market: 16.67% and below

Seller’s market: 33.33% and above

Neutral market: 16.67% - 33.33%

Absorption Rate based on Closed Sales

The March 2024 Absorption Rate based on Closed Sales of 185.2 was increased by 122.3% compared to last year and up 5.8% compared to last month.

Absorption Rate based on Pended Sales

The March 2024 Absorption Rate based on Pended Sales of 244.4 was increased by 132.8% compared to last year and down 6% compared to last month.

All reports are published April 2024, based on data available at the end of March 2024, except for the today’s stats. Information and statistics derived from Northwest Multiple Listing Service. Neither the Board or its MLS guarantees or is in any way responsible for its accuracy. Data maintained by the Board or its MLS may not reflect all real estate activity in the market. Report reflects activity by all brokers participated in the MLS.

You agree to receive property info, updates, and other resources via email, phone and/or text message. Your wireless carrier may impose charges for messages received. You may withdraw consent anytime. We take your privacy seriously.